By Thomas Paulson, Head of Market Insights

Tractor Supply reported $3.47B in sales for Q1, a +2.1% increase vs. last year and slightly less than Advan’s estimate of $3.52B (-1.5% miss). We suspect that the miss was due to the timing of Easter, which would have pushed sales into the last day of the quarter last year; average ticket slipped by -120 bps QoQ to a -2.9% YoY decline. Weather was also very disruptive this year, which pushed seasonal sales later in the period, adversely impacting both traffic and comp-ticket. Total sales growth was also impacted by the absence of Leap Day this year, and who knows how that extra day would have been an influence on comp sales as well. Big ticket items (15% of sales) also swung from YoY increases in ’24 to a double-digit decline. The steeper contraction in average ticket (despite positive UPTs) was the result of the decline in big ticket items and strong growth in lower-priced heating fuel. And so, in our view, absent the swing in big ticket, the estimate miss was largely due to exogenous effects and not due to any change in the business or its long-term potential.

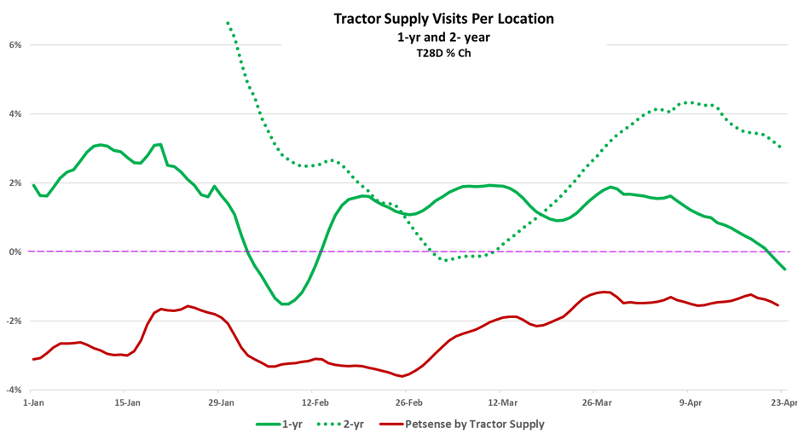

As seen in the chart, April traffic has been slower on a 1-year basis given a more difficult comparison. Nonetheless, based on the YTD trendline and tariff uncertainty, management lowered its guidance for the year. They expect Q2 comps to be in the range of flat to +1%. Achieving the middle of that range would put the 2- and 3-year comp CAGRs at Q1 levels, i.e. no real underlying +/- change. Separately, management was asked how their pet business (Petsense from Tractor Supply) was doing after a difficult three years for the category, and CEO Hal Lawton said, “On pet.., we do think we've passed the trough on pet… we continue to gain share on top of that modest step up and feel very good about how we're moving forward in pet.” (Recall that PetSmart and Petco have seen a meaningful step-down last quarter and recently – more lost share to mass, club, and online only.)

CFO Kurt Barton said, “These results were below our expectations, and we believe that weather was the key swing factor on our results in the quarter. Where our business had a normal transition to spring, we were pleased with the results. Unfortunately, that was not in the vast majority of the country, and we estimate the arrival of spring was delayed by about 3 weeks across most of our markets, especially in the Midwest and Northeast, where there was snow just last week. Looking at the cadence of comparable store sales over the quarter. We began with a strong January, successfully comping over last year's performance. When evaluating January and February together, we were particularly pleased with the results in our cold-weather categories, which performed well. However, the momentum has slowed as we moved into mid-February and March. Typically, we begin to see early signs of spring in the south by mid-February. But this year, that transition was delayed due to prolonged cold temperatures and winter storms, which extended into mid-March. As a result, demand for spring seasonal categories was significantly softer than anticipated. In the first quarter, spring is much more important in the South than winter in the North. To give you some further perspective, our spring categories in the South were down about 30%. In total, we estimate that the delay in spring weather was a headwind of about 250 basis points. Also, it's important to recall that we were lapping an early Easter in 2024, which we estimate was approximately a $20 million headwind to comp sales in the quarter…”

On the guidance reduction, CEO Hal Lawton said, “The updated fiscal year outlook is reflective of three primary considerations. One, it flows through the seasonal spring softness we've experienced to date. Two, it assumes that pressure on big ticket categories will persist for the remainder of the first half. And three, it reflects a range of scenarios related to tariff cost, that our vendor base and we are incurring in the second quarter. In other words, we've considered the implications of tariffs through the 90-day pause that began on April 9.” And on the pass through of tariff costs, he said, “We're already seeing requests for price increases from select vendors in areas of the market, and I fully expect that we'll see more in the coming weeks and months. Where we take price, we will be surgical, category-by-category, SKU-by-SKU, leveraging our portfolio strategy, always with a top priority being a focus on value perception, but also always with an understanding of margin sustainability… Ultimately, our goal isn't just to offset cost, but it's to protect long-term trust with our customers. Our customer loyalty remains strong, and we feel confident in our ability to navigate this moment while continuing to grow profitably. “

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.